BRF #52 Insolvency

Well I guess its time we talked about the Celsius and 3AC blow ups recently that was part of the Bitcoin dump. In fact as I type this Bitcoin just lost $20k, but the thought dawned on me the other day- what if this is it, how would I feel?

First off, I don’t think this is it and cryptos are dead, we hear that every cycle and every time people say things like “well this time its different” and it never is because markets are people and people are markets.

Anyway back to the thought, which by the way I think reflection like this is healthy for individuals to regularly do. I would say I am extremely happy, not satisfied though. Like if crypto went away tomorrow, I would be bummed out because its given me so much and I feel like I haven’t given enough back yet.

Lets rewind the tape back here over the last 5 years now being involved in cryptocurrencies, has completely changed my life in so many ways. It changed my finances, changed the way I look at the world, I learned economics, how to trade *(kinda), psychology (well a different variety of it) and on and on I could go.

Deep character traits of mine have been solidified over this last 5 years, the foundation was already there but they turned into something over this time I have spent in crypto.

I say all this because I am not sure how these emails come across but some might think that I am just always dogging on crypto and yes you are correct- I am! But its because I know we can do more, keep pushing and finish the original dream of disrupting the primary system of control which is money.

Its just weird, I mean I look around and ton of people got rich and left, some kept launching dogsht to make money, you got the whole youtuber ecosystem which is trash filled with pretenders all secretly hoping you click an affiliate link or help fill their orders on the latest lie. Some created scams like bad coins and exchanges that offer 120x leverage like CZ, who doesn’t care about crypto but only motherland china. How many are actually out there fighting the “good fight”, trying to change the system vs now fight for their own survival in a banking run V2.0 system?

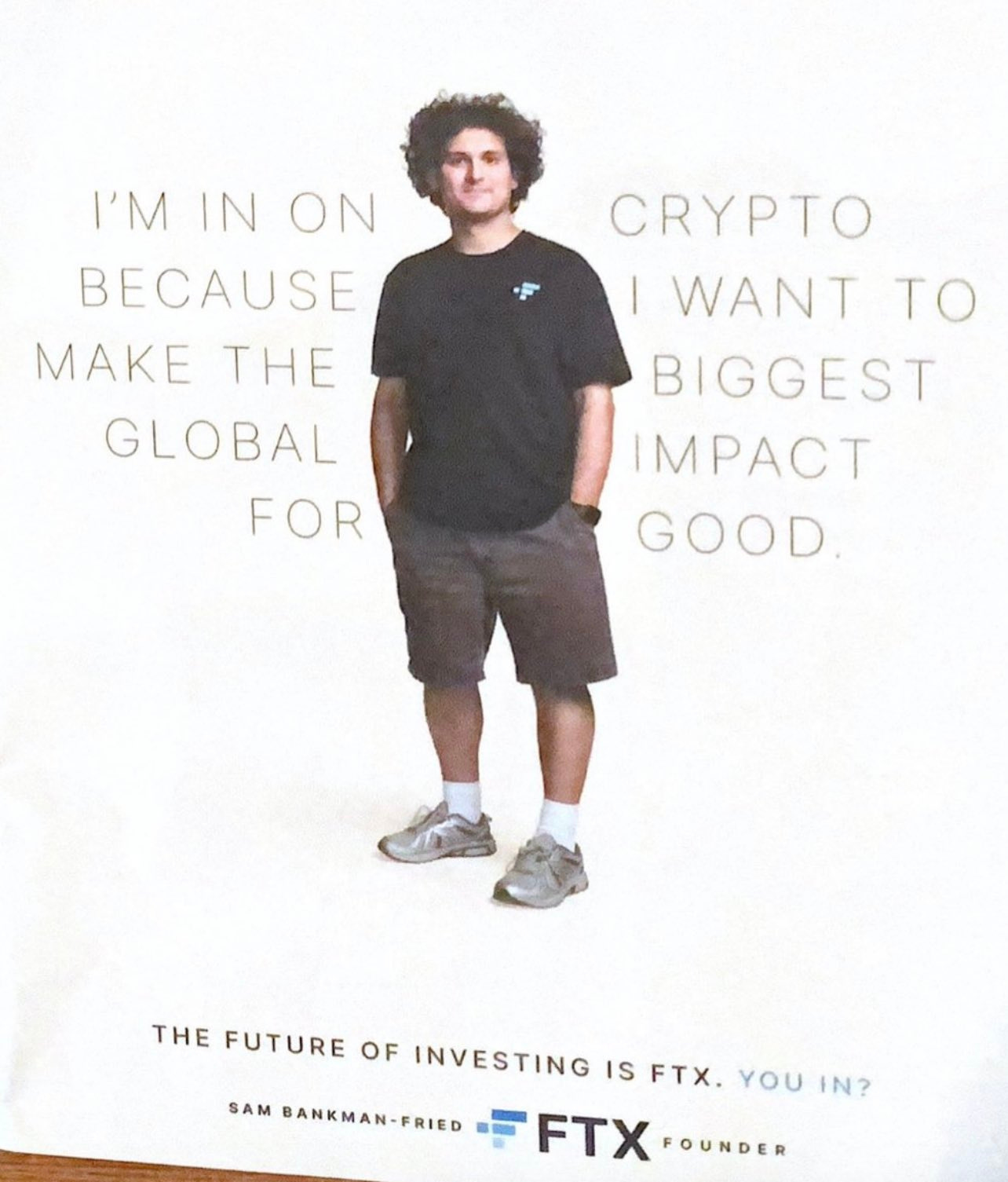

You think sam out here fighting for you?

This is just an ad, not the truth on how he feels but how he wants you to see him.

This guy is not here to help you! In fact he was helping push down the price chasing Celsius liquation. How is that helping you? More on that in a minute.

So yes, in short I would be disappointed as all I am seeing lately is horribly run illegal securities and infiltration from bankers and politicians, who have now slowly dialed this entire market into an alternative bankers playground for them and their friends!

I think we can do better, Bitcoin is not the finish line- I truly feel sorry for anyone who actually feels that way out there, or who have wrapped up too much of their identity around any project because they are gonna get rekt twice, first on price then on community.

Ok so probably time we talk about the elephant in the room and its great because it won’t take long.

Up until about 2019 the big mover in the crypto market was exchanges, think back to Bitmex liquidation engine debacle back in late 2018. Then the SEC, DOJ, FBI did what they do best- eliminated the competition and all but destroyed Bitmex. From that point on it was no longer exchanges running the show but tradefloors and VCs. The amount of VC leverage dumped into the crypto system over the last year and a half was incredible and as we have seen (cough cough 3AC) not all of them were on the right side of the trade.

So in 2022, we now see exchanges and trading floors making alliances and packs to take down other exchanges, trading floors & VCs. What is the bigger plan here because lets not forget FTX is a dirty biden donor, they donated $5M to his campaign, which was the highest donation (through proper channels at least) ever at the time.

You can go back and look at trade volume during the dump, it was 90% FTX, Alameda and FTX chasing the original $21k Celsius liquidation level.

The more exchanges, VCs, and trading floors that blow up now, opens up more room for bankers and ex-obama era politicians aka the wrong people. I point to the thread Jess Powell (CEO of Kraken) just posted in the last 48hrs talking about hiring a bunch of the wrong people and having to squash out woke culture. Lets think back similar happened to Brian Armstrong with Coinbase.

Originally I had this whole bit about how I thought 3AC intentions were pure as they seemingly went down with the ship, meaning they were thinking up only the whole time and doubling down on leverage, but turns out that might not be true, just found this.

I mean in the end we may all go down with the ship, and I am ok with that. I feel like I owe a lot to crypto and want to stick around till either change does in fact happen or the end comes. What else am I gonna do but stand and fight what we are clearly up against?

As of right now, Celsius has paid down a lot of the note and liquidation is around $16k, no one knows what happened to the $400M loan Saylor took out which I thought has a liquidation somewhere between $20k-$22k, and looks like 3AC went from over $2B in asset value to nothing and ghosting everyone. There was also a ton of options at the $20k level for Bitcoin and $1k level for ETH, with expiration for the end of this month so now that we just lost $20k level that means a lot of options volume will be puking positions here over the weekend. At the rate we are going with firms and traders blowing up/severely under water we could see $10k again.

How many other smaller traders and firms just blew up? Will they get a bank bailout like the bankers have twice now in the last decade? Doubt it! What we do know is $2T in market cap was wiped clean now, that energy went somewhere. Who is going to step in a buy at these levels? How many traders are actually left with money on the sidelines and not insanely underwater?

Mark my words, this is the worst dump/bearish situation I have seen in terms of damage to crypto ever!

A few updates since queuing this up to be sent out:

Bitcoin tapped $18,700

Resources & Tools

Buy some stuff or send me some cash if you want to say thanks or support me!

Nordvpn:

Regardless if you trade crypto or not, you don’t want your regular IP exposed for data providers to sell off to marketing firms and/or further down the road be used against you. Protect your geo-location with at least one layer VPN with Nord. 2yr deal currently 68% off!

Tip me Crypto! Tip me on Cashapp: $JamesonBrandon

Peak Performance:

Daily greens I have used for last 5 years: https://amzn.to/2QodZC9

BCAAs I have used for last 2 years: https://amzn.to/2rlnsvX